Table of Contents

- 1. The Foundational Shift to ESG

- 2. What is ESG? An Overview for Indian Corporations

- 3. Navigating India’s ESG Regulatory Framework

- 4. Key ESG Risks for Indian Corporations in 2025

- 5. Legal Precedents: Case Studies and International Lessons

- 6. Future Outlook: Emerging Trends in Indian ESG Compliance

- 7. Conclusion: The Path to Sustainable Growth and Legal Resilience

- 8. Frequently Asked Questions (FAQ)

AUTHORED BY ADITYA GARG

As a third-year BA LLB student at the University of Mumbai and a Company Secretary Executive Programme candidate (having cleared Group 2), I am Aditya Garg. My academic interests are primarily in Corporate and Commercial Laws, with a specific focus on Corporate Social Responsibility (CSR), Environmental, Social, and Governance (ESG) practices, Due Diligence, Insolvency, and Merger & Acquisitions.

Edited by: Vikramaditya Buddhist

1. The Foundational Shift to ESG

The business world is undergoing a profound transformation. What was once seen as a niche concern—a topic for corporate social responsibility (CSR) departments—has evolved into a core part of business strategy, risk management, and legal compliance. In India, this shift is particularly dramatic. The old Companies Act of 1956 was replaced in 2013 by a new act that brought major legal updates, focusing on iproving corporate governance and responsibility. Regulators are now building a stronger corporate and legal system, emphasizing board transparency and effective management. ESG, once a buzzword, is now a fundamental corporate responsibility.

This article provides a detailed explanation of ESG compliance, the legal risks, and the challenges that Indian corporations are facing as they navigate this new landscape. It covers the critical frameworks like SEBI’s Business Responsibility and Sustainability Reporting (BRSR), key legal precedents, and international standards that are shaping the future of business in India. By exploring these topics, this guide aims to provide practical insights for fostering sustainable growth and managing legal obligations in a rapidly changing environment.

2. What is ESG? An Overview for Indian Corporations

ESG, or Environmental, Social, and Governance, is a framework used to measure an organization’s performance beyond just financial results. It provides a way to gauge whether a company is fulfilling its commitments to environmental care, social responsibility, and good governance for the benefit of all stakeholders, from investors and employees to the general public.

- Environmental (E): This pertains to a company’s impact on the environment and how it manages these impacts. This includes pollution, climate change, energy use, and the management of physical hazards caused by natural events like floods or earthquakes.

- Social (S): This explores how a company affects people, including employees, customers, and the communities it serves. It involves topics such as fair wages, employee morale, and community engagement.

- Governance (G): This refers to how an organization is run and managed. It includes ethical decision-making, board structure, and the protection of shareholders’ rights to ensure transparency. Governance is a critical component of ESG and is closely watched by analysts.

The concept of ESG is rooted in the socially responsible investing (SRI) movements of the 1970s and 1980s. The term was formally introduced in 2004 by the United Nations Global Compact, and it has since grown to become a crucial factor for institutional investors. 1They have realized that paying attention to factors like reducing greenhouse gas emissions not only improves a company’s financial performance but also strengthens its ability to manage risks effectively. The Global Reporting Initiative (GRI), established in 1997, initially focused on environmental issues but has since broadened its scope to include social and governance topics, reflecting the expanding impact of businesses on the world.

3. Navigating India’s ESG Regulatory Framework

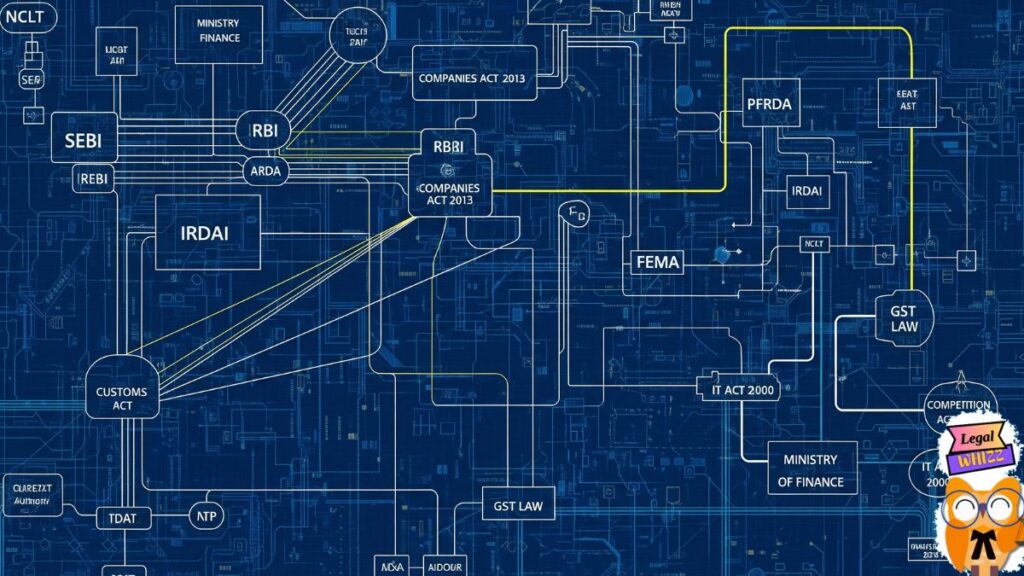

India’s ESG legal and regulatory framework is a comprehensive, yet fragmented, system that spans multiple laws and authorities. For global companies, this “legal minefield” requires a deep understanding of unique, sector-specific requirements. The framework can be broken down into four primary parts :

3.1. SEBI’s BRSR Framework: Key Requirements and Timelines

The Securities and Exchange Board of India (SEBI) has been a key driver of ESG compliance in the country. The SEBI Business Responsibility and Sustainability Report (BRSR) framework, which replaced the earlier Business Responsibility Reporting (BRR), mandates that India’s top 1,000 listed companies by market capitalization provide comprehensive ESG disclosures. This new framework, which became effective in 2023, is aligned with global reporting standards like GRI and TCFD. It requires companies to respond to 140 questions on their ESG performance, with 98 mandatory indicators and 42 voluntary ones.

A key part of the new framework is the BRSR Core, which requires reasonable assurance from top listed companies. This is a significant move away from voluntary reporting and toward disclosures that are mandatory, detailed, and subject to audit.

3.2. Corporate Social Responsibility and the Companies Act, 2013

While not a direct ESG law, the Companies Act, 2013, has several provisions that align with ESG principles, most notably its mandatory CSR rules. The law requires companies that meet certain net worth, turnover, or net profit thresholds to spend a portion of their average net profits on CSR activities, such as education, healthcare, and environmental protection.

The Act also addresses corporate governance by requiring companies to have independent directors, audit committees, and risk management systems. These provisions are designed to ensure transparency, efficiency, and accountability in a company’s operations.

3.3. Sector-Specific ESG Laws in India

Certain sectors, due to their significant impact on society and the environment, must follow strict ESG regulations.

- Energy Sector: Companies are regulated by the Electricity Act and the Energy Conservation Act. They must operate within pollution limits and are often required to install emission control systems.

- Mining Sector: This sector is governed by the Mines and Minerals (Development and Regulation) Act and must obtain environmental and forest clearances before starting work. Companies like Coal India have undertaken land reclamation and afforestation efforts.

- Manufacturing Sector: This sector is regulated by the Factories Act and Extended Producer Responsibility (EPR) rules. For example, plastic manufacturers are now required to collect and recycle their plastic waste.

3.4. The Role of RBI in Green Finance and Climate Disclosure

The Reserve Bank of India (RBI) is actively addressing climate risks in the financial sector. The RBI has introduced a draft disclosure framework for a range of financial institutions, from scheduled commercial banks to non-banking financial companies. The framework, which is being implemented in a phased manner, requires disclosures on a company’s governance, strategy, and risk management related to climate change. This is designed to ensure financial stability as climate-related risks worsen.

4. Key ESG Risks for Indian Corporations in 2025

As ESG regulations become more stringent, companies face a new set of interconnected risks. A failure to manage these can lead to significant financial and reputational damage.

- Regulatory Risks: Non-compliance with ESG guidelines can lead to severe penalties from regulatory bodies like SEBI or the National Green Tribunal.

- Reputational Risks: Poor ESG performance can damage a company’s public image and lead to a loss of investor confidence. Negative social media reactions or foreign investors pulling out their money are common examples.

- Operational Risks: Regulatory violations can disrupt daily operations. Authorities have the power to shut down plants or halt production, leading to material shortages and delays.

- Litigation Risks: Companies can face legal action from NGOs, shareholders, or other parties if they fail to meet ESG standards. This can be seen in cases of river pollution or a failure to disclose ESG data.

4.1. The Risk of Greenwashing

One of the most serious and growing threats is greenwashing. This occurs when a company misleads the public about its environmental or social practices. India is currently facing this problem, and it needs to be addressed. The absence of a clear framework to combat this can lead to companies exaggerating their sustainability efforts. This “mirage” of environmental responsibility can deceive the public and attract investors under false pretenses.

5. Legal Precedents: Case Studies and International Lessons

5.1. The Vedanta Sterlite Copper Plant Case

The case of the Vedanta Sterlite Copper Plant serves as a landmark example of ESG accountability in India. After operating for two decades, the plant faced accusations of causing air and water pollution. The Supreme Court of India ordered the company to pay Rs. 100 crore in environmental compensation, a ruling that highlighted the critical need to balance industrial growth with environmental protection and public health. The plant remains closed, underscoring the long-term consequences of failing to meet environmental standards.

5.2. The Santos Case: A Global Warning Against Greenwashing

In 2021, the Australian Centre for Corporate Responsibility (ACCR) initiated a lawsuit against Santos Ltd., accusing the company of greenwashing. The suit alleged that Santos made misleading statements about its net-zero emissions goals while still proceeding with major fossil fuel projects. This case demonstrates the emerging legal threat of greenwashing litigation and reinforces that ESG promises must be supported by transparent and honest information. While India has yet to see a similar lawsuit, authorities have taken action against companies for false claims, and public interest litigations challenging misleading environmental claims are growing.

6. Future Outlook: Emerging Trends in Indian ESG Compliance

The ESG landscape is constantly evolving. In 2025 and beyond, Indian corporations should anticipate several key trends:

- Global Standards: The International Financial Reporting Standards (IFRS) Foundation has launched two new standards, IFRS S1 and IFRS S2, to create a common global framework for ESG reporting. IFRS S1 covers broad sustainability reporting, while IFRS S2 focuses specifically on climate-related risks.

- Supply Chain Accountability: The European Union’s Corporate Sustainability Due Diligence Directive (CS3D), which takes effect in 2027, will require companies to identify and manage human rights and environmental risks in their supply chains. This will directly impact Indian exporters and suppliers who work with EU clients.

- The Anti-ESG Movement: A growing anti-ESG movement, particularly in the United States, is prompting companies to rethink their sustainability commitments. This could lead to a greater focus on initiatives that deliver real, measurable value rather than just following a checklist.

- Litigation and Enforcement: The increase in greenwashing lawsuits is expected to continue. Regulations like the EU’s double materiality rules and a greater focus on supply chain practices provide new grounds for legal action, especially regarding misleading net-zero claims.

7. Conclusion: The Path to Sustainable Growth and Legal Resilience

“In the changing corporate world of 2025, ESG compliance is not optional- it is

the key to staying in business, growing, and gaining global trust.”

Financial institutions have to see these regulatory changes as not just something they have to follow, but as chances to be innovative, technologically advance and led in sustainable finance and its oriented areas. This also can be achieved by improving their ESG frameworks, working with stakeholders, and using better reporting

technologies, companies can turn regulatory challenges into strategic benefits and can ultimately use them for their own benefits. Start by looking at fund names to make sure they match SFDR categories and build the ability to meet CSRD and IFRS requirements. Those who act now will not only meet the rules but also build trust with investors, improve their position in the market, and help advance the global sustainability agenda with a

forward-thinking approach and will definitely going to rule the upcoming ESG domain.

Morality isn’t just philosophical—it’s constitutional. See how it’s understood in our legal framework.

8. Frequently Asked Questions (FAQ)

What is the purpose of ESG compliance for Indian businesses?

ESG compliance helps Indian companies manage risks, attract capital from ESG-focused investors, enhance their reputation, and ensure long-term sustainability.

What are the key ESG regulations in India?

The key regulations include SEBI’s BRSR framework, the Companies Act, 2013 (specifically Section 135 on CSR), and various sector-specific environmental laws.

Does the BRSR framework apply to unlisted companies?

Currently, the BRSR framework is mandatory only for the top 1,000 listed companies by market capitalization in India. However, some unlisted companies may voluntarily adopt the framework to improve transparency and attract investment.

What are the biggest challenges companies face with ESG compliance?

Key challenges include the persistent risk of greenwashing, inconsistent implementation across different sectors, and the difficulty smaller businesses face in adopting robust ESG practices.

How can companies avoid greenwashing?

To avoid greenwashing, companies should ensure their ESG disclosures are transparent, accurate, and supported by robust data. They should also consider independent, third-party audits or certifications for their claims to enhance trust and credibility.

Want to know is Marital Rape a crime in India? Click here

Hello my loved one I want to say that this post is amazing great written and include almost all significant infos I would like to look extra posts like this

Thank you so much for your review

– Aditya Garg ( author of this article)