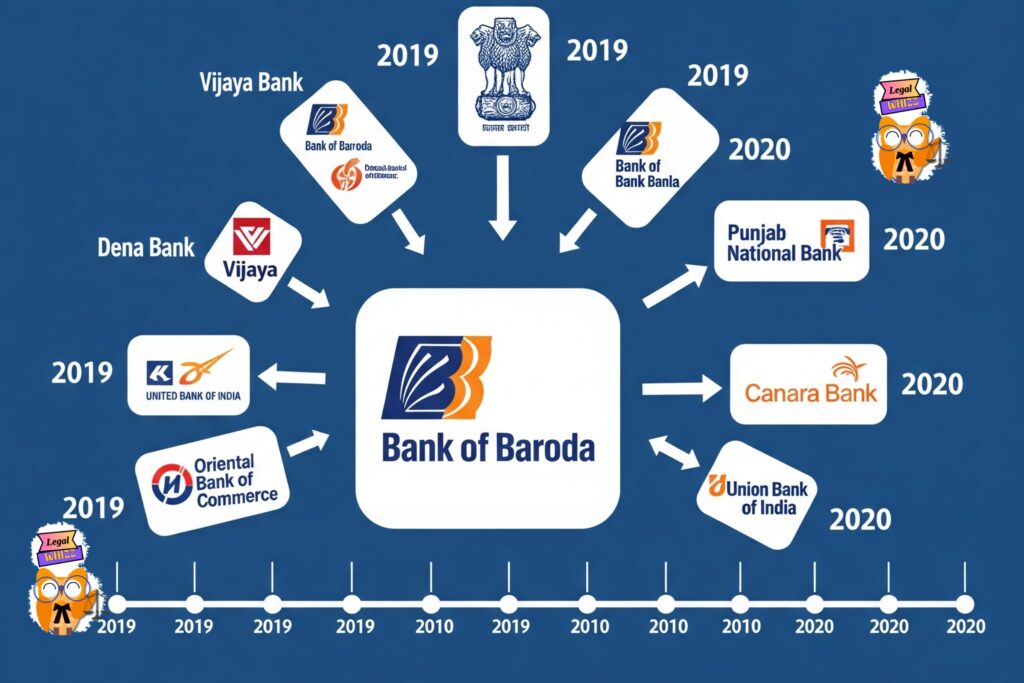

The banking industry is the backbone of India’s liberalized and globalized economy. As a crucial source of credit, it fuels industries, supports small and medium-sized businesses, and serves as a lifeline for retail clients. Recently, bank consolidation in India has become a central theme, particularly among Public Sector Banks (PSBs), which account for nearly 80% of the industry’s net income.

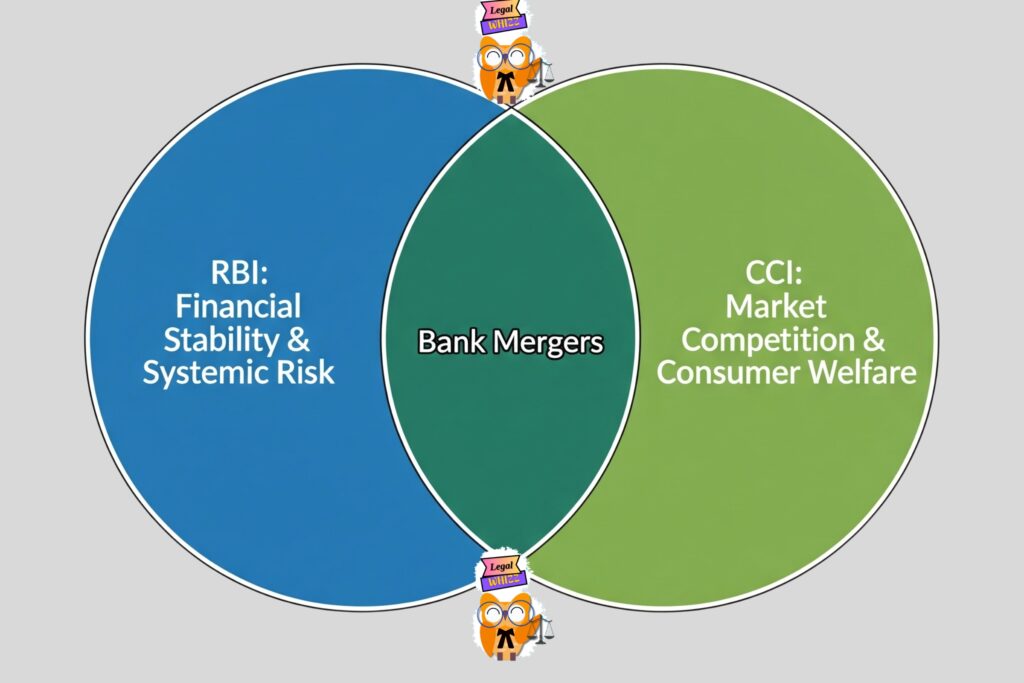

This push for consolidation aims to create larger, more competitive, and globally viable banking institutions. However, this trend brings two powerful regulators into a potential conflict: the sector-specific regulator, the Reserve Bank of India (RBI), and the market-wide competition authority, the Competition Commission of India (CCI).

The RBI, governed by the Banking Regulation Act of 1949, has historically overseen bank mergers under Section 44A. It argues that the unique, systemic risks of the financial sector require its specialized oversight. On the other hand, the Competition Act, 2002, empowers the CCI to review any merger or “combination” that could negatively impact market competition, placing bank mergers squarely within its jurisdiction.

Author

Monalisha Patro is a BBA LL.B student with a strong academic focus on Intellectual Property Rights and Cyber Law. She is deeply interested in contemporary legal issues, particularly at the intersection of law and technology, and is committed to contributing to scholarly discourse through rigorous legal analysis and writing.

Edited By : Vikramaditya Buddhist

This article explores the motives behind bank consolidation in India, examines how these mergers are treated under competition law, and analyzes the critical jurisdictional tussle between the RBI and CCI.

Key Motives Driving Bank Consolidation in India

The push for bank consolidation is not arbitrary; it’s driven by several strategic economic and market factors aimed at strengthening India’s financial architecture.

- Creating Global Giants: A primary driver is the need to create banks with the scale and balance sheet size to compete on the global stage. While India’s state-owned banks dominate the domestic market, they are relatively small compared to their international peers1. Consolidation is seen as a way to create entities that can propel growth in the global market.

- Meeting Expanding Capital Requirements2: As the economy grows, so does the demand for credit. The RBI has noted that consolidation is necessary to meet the expanding capital requirements of banks, ensuring they remain well-funded and stable.

- Improving Customer Service and Reach: Many of India’s sub-scale banks lack the resources to invest in technology and serve mass-market retail, SME, and agricultural sectors effectively. Consolidation allows for greater investment in innovation and customer service.

- Achieving Revenue and Cost Efficiency: Mergers can lead to significant efficiency gains. By combining operations, banks can eliminate redundant expenses (cost efficiency). Larger, consolidated banks can also offer a wider array of products and services, capturing a larger share of customer activity and increasing revenue (revenue efficiency).

- Increasing Market Power: Merging banks within the same geographic area reduces the number of local competitors. This can increase the surviving entity’s profitability by allowing it to adjust loan and deposit rates. However, this is precisely the outcome that attracts scrutiny from competition authorities.

Bank Mergers Under the Competition Act, 2002

The Competition Act, 2002, brought bank mergers and amalgamations under regulatory review for the first time, a departure from the previous MRTP Act of 1969. The Act defines a “combination” to include mergers, amalgamations, and acquisitions of shares, assets, or control.3

A proposed combination must be notified to the CCI if it crosses certain asset and turnover thresholds. For example, if the combined entity has assets of more than ₹1,000 crores or a turnover of more than ₹3,000 crores in India, it falls under CCI’s jurisdiction.

Once notified, the CCI investigates the combination to determine if it is likely to have an Appreciable Adverse Effect on Competition (AAEC) within the relevant Indian market. Any combination deemed to have an AAEC is considered void.

The goal is to prevent the creation of monopolies that could harm consumer interests by:

- Making it easier for remaining players to engage in price-fixing or collusion.

- Granting the merged firm unilateral power to raise prices.

- Creating a dominant entity that could later abuse its market position.

The Jurisdictional Tussle: RBI vs. CCI

The core of the regulatory debate lies in the overlapping authority between the prudential regulator (RBI) and the competition regulator (CCI). This has created significant uncertainty for the banking sector.

The RBI’s Position: A Need for Prudential Oversight

The RBI has argued for exempting the banking sector from the CCI’s merger review process. Its key arguments are:

- Systemic Stability: The banking sector is “special” and interconnected. A bank failure can trigger a systemic crisis, unlike in other industries. Therefore, ensuring financial stability and protecting depositors must be the primary goal, sometimes even at the expense of pure competition.

- Urgency and Forced Mergers: In times of financial distress, the RBI may need to orchestrate a “forced merger” of a weak bank with a strong one quickly to prevent a collapse. A lengthy CCI review could be catastrophic in such a scenario.

- Sector-Specific Expertise: The RBI possesses deep knowledge of the banking industry’s unique risks and operations, making it better suited to judge the viability and impact of a merger.

The CCI’s Position: Protecting Market Competition

The CCI counters that its role is distinct from and complementary to the RBI’s. Its main points are:

- Protecting Consumers: The RBI’s focus is on the health of the bank, while the CCI’s focus is on the welfare of the consumer. Unchecked consolidation can lead to higher fees, lower deposit rates, and reduced choices for customers.

- Level Playing Field: The CCI argues that public sector banks already enjoy an unfair advantage due to certain entry barriers. Allowing unchecked mergers would further concentrate the market and stifle competition from private and foreign banks.

- Distinct Mandates: Prudential regulation (RBI) and competition law (CCI) are two sides of the same coin, both aiming for a healthy economy. The RBI ensures banks are safe, while the CCI ensures they are competitive. One mandate should not exclude the other.

Conclusion: The Path Forward

The coexistence of sectoral regulation and competition law is a complex but essential feature of a modern economy. In India, the consolidation of banks highlights a critical regulatory gap between the RBI and the CCI.

While the RBI rightly focuses on systemic risk and financial stability, the CCI is the designated guardian of market competition and consumer welfare. The lack of a formal, statutory coordination mechanism between them creates uncertainty, delays, and the potential for conflicting regulatory outcomes.

As India’s banking sector continues to evolve, establishing a clear, cooperative, and legally transparent framework for interaction between the CCI and RBI is essential. By integrating international best practices, India can ensure that its banking reforms achieve the dual objectives of creating globally competitive institutions while maintaining a vibrant, competitive, and consumer-friendly market.

Liked this? Read Marital Rape in India: Why the Legal Exception Needs an Overhaul